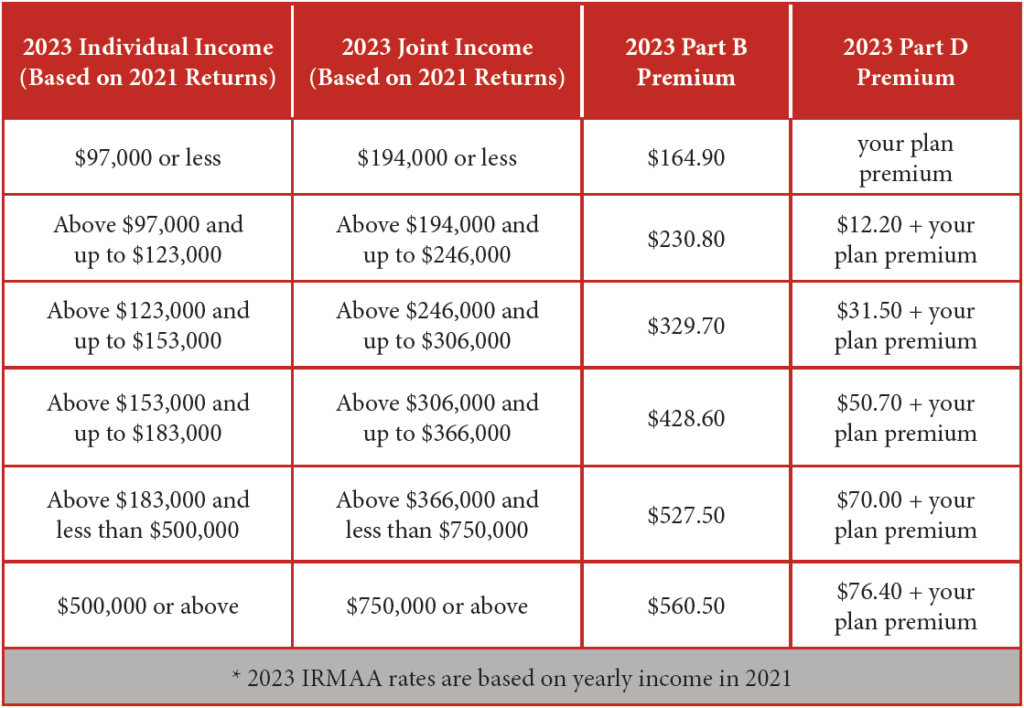

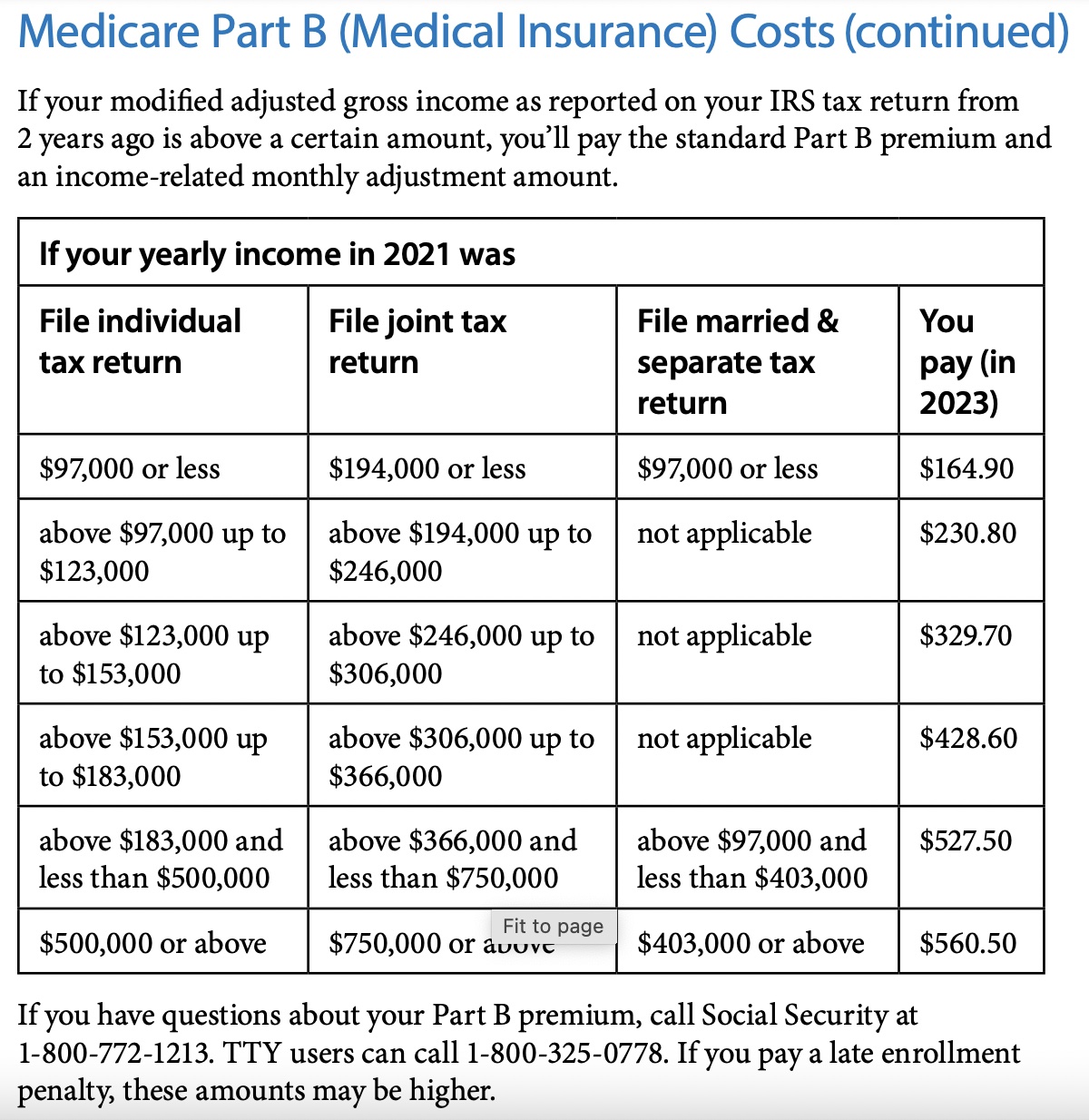

Irmaa Brackets 2025 Married Filing Jointly 2025. Magi (2025) part b premium. For married couples filing jointly, the irmaa threshold is higher than for single filers.

Filing individually income > $106,000 married filing jointly income > $212,000 For 2025, you’ll find several distinct income brackets that determine your irmaa surcharge.

2025 Irmaa Brackets Married Filing Jointly Joe Brown, Your 2025 irmaa is based on your 2025 tax return.

Irmaa Brackets 2025 Married Filing Separately James Ball, For example, if your modified adjusted gross income (magi) exceeds $97,000 for individuals or $194,000 for couples filing jointly, you will likely see an increase in your.

Irmaa Brackets 2025 Married Filing Jointly Dominic Edmunds, By next year the thresholds, if inflation remains constant, irmaa brackets.

Irmaa 2025 2025 2025 Neet Lillian Turner, Irmaa is reassessed annually based on your most recent tax return.

Estimated 2025 Irmaa Brackets April Brietta, Get expert advice from henry beltran of medicare advisors insurance.

Irmaa Brackets 2025 Charter Roxy Wendye, By next year the thresholds, if inflation remains constant, irmaa brackets.

Irmaa Tax Brackets 2025 Berti Gratiana, They also share an income bracket when it comes to calculating their medicare premiums.

Irmaa Brackets 2025 Charter Roxy Wendye, For 2025, the irmaa brackets are determined by the income reported on 2025 tax returns, with thresholds starting at $103,000 for individual filers and $206,000 for married couples filing jointly.

Projected 2025 IRMAA Brackets Understanding The Monthly, Filing individually income > $106,000 married filing jointly income > $212,000